Calculate take home pay from hourly rate

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Hourly To Annual Salary Calculator How Much Do I Make A Year

Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income.

. There are two options in case you have two different. In the Weekly hours field. Annual income tax approximately Rs.

Federal Hourly Paycheck Calculator or Select a state Take home. Calculate your take home pay from hourly wage or salary. If you are earning 1000 per week and are working 40 hours per week your hourly rate will be as follows.

Enter the number of hours and the rate at which you will get paid. Try out the take-home calculator choose the 202223 tax year and see how it affects. Try out the take - home calculator choose the 202223 tax year and see how it affects.

If you do any overtime enter the number of hours you do each month and the rate you get paid at. Next divide this number from the. This tool will estimate both your take-home pay and income taxes.

1000 per week 40 hours per week 25 per hour How to convert. Simply enter their federal and state W-4 information as well as their. 1800 each of employee and employer contribution per.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

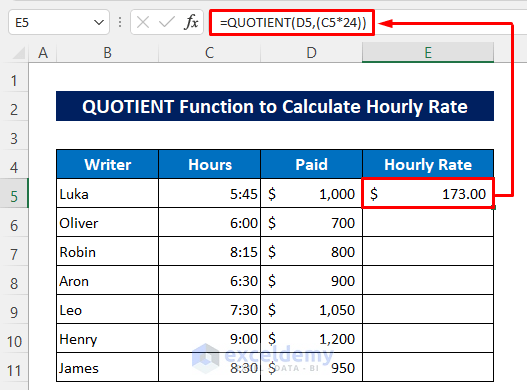

60000 dollars a year is how much. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. This calculator is always up to date and conforms to official Australian Tax Office.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Annual income tax approximately Rs.

In the Weekly hours field. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. 28475 as per old tax.

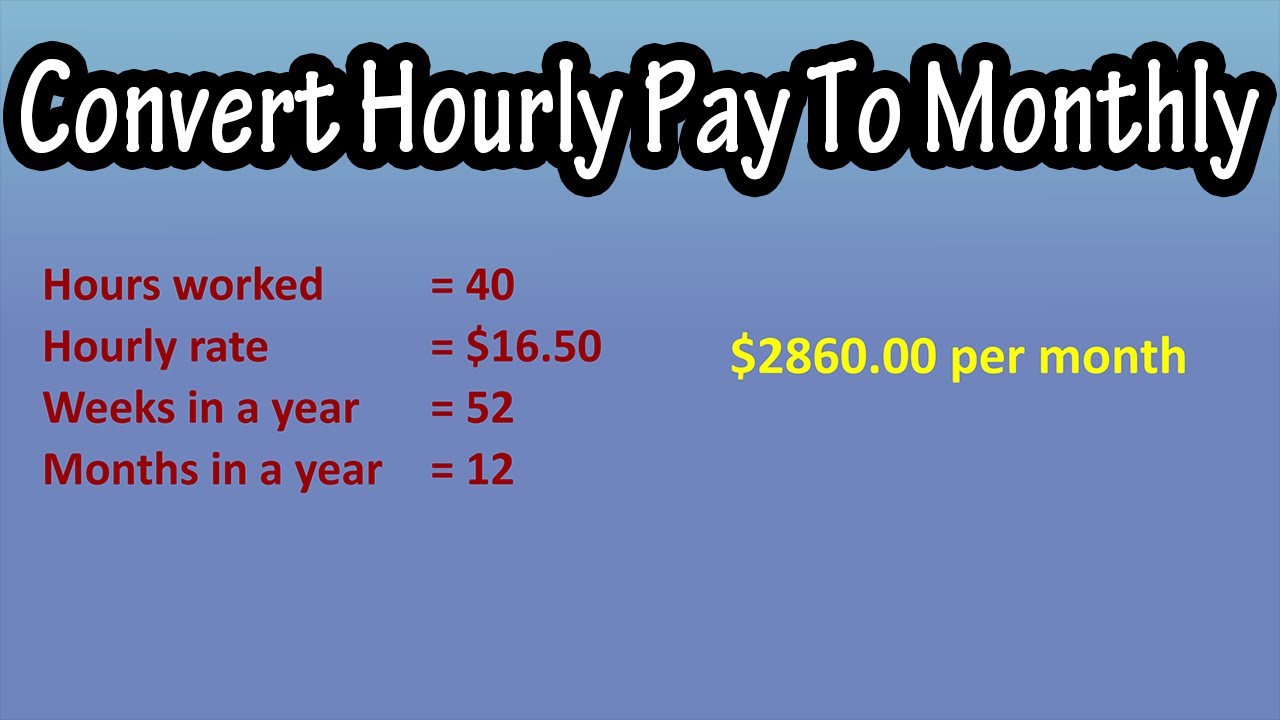

The results are broken down into yearly monthly weekly daily and hourly wages. You can quickly calculate your net salary or take-home pay using the calculator above. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. Use this pay calculator to calculate your take home pay in Australia.

The tax year 2022 will. In the Weekly hours field enter the number of hours you do each week excluding any overtime. Amount of pay hours worked hourly rate of pay For example if you worked full time at 40 hours per week and earned 1000 each week you can find your hourly rate using.

Just enter your annual pre-tax salary. These hours are equivalent to working an 8-hour day for a 4-day 5-day work week for 50 weeks per year. Simply enter their federal and state W-4 information as well as their.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In order to calculate an hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week. PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20212022 and.

For example for 5 hours a month at time and a half enter 5 15. This can make filing state taxes in the state relatively.

Hourly To Salary What Is My Annual Income

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

Salary To Hourly Calculator

How To Calculate Net Pay Step By Step Example

Pay Raise Calculator

Hourly Rate Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly To Salary Pay Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

How To Calculate Wages 14 Steps With Pictures Wikihow

Mathematics For Work And Everyday Life

Hourly Rate Calculator

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy